The challenge of UBO identification

For financial institutions, identifying Ultimate Beneficial Owners (UBOs) is a regulatory requirement that can quickly turn into one of the most time-consuming steps in corporate onboarding. KYC and KYB teams are often confronted with complex ownership structures involving multiple layers of corporate shareholders across jurisdictions.

Traditionally, this requires analysts to manually:

- Download shareholder lists and commercial register documents for the client company and all of its parent entities

- Read and cross-reference each document to trace beneficial ownership

- Build the ownership structure by hand, often across spreadsheets or diagrams

This manual process can easily take hours or even days, introducing the risk of errors, missed links, and compliance gaps.

The Sinpex solution: UBO Drilldown

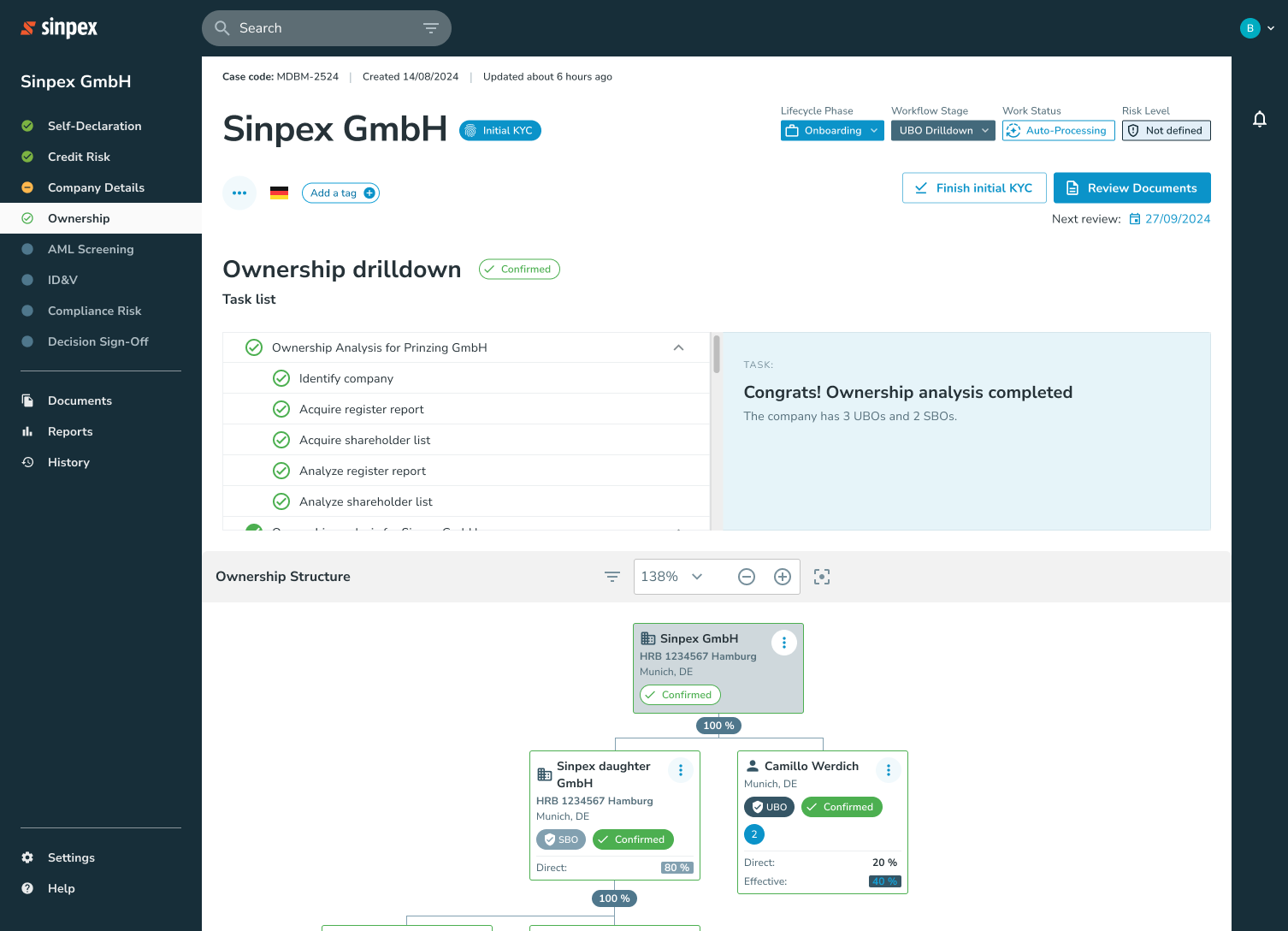

Sinpex has developed a new UBO Drilldown that automates this entire investigation process. Instead of spending days untangling ownership trees, analysts can now initiate a single automated workflow:

- Enter the client company in the Sinpex platform.

- The system retrieves official registry documents and shareholder data.

- An interactive ownership tree (image below) is automatically generated, showing the full structure across all corporate layers.

- A guided task list flags the few steps that need manual confirmation and displays the corresponding actions to solve the task, ensuring nothing is overlooked.

- A UBO table is generated below where processes like AML Screening or ID&V can be triggered either automatically or manually

What once required endless manual research now takes just minutes — with higher accuracy and full traceability.

Key advantages of UBO Drilldown with Sinpex

- Significant time savings: Automates hours or days of manual research into a few minutes of guided verification.

- Enhanced accuracy: Minimizes the risk of human error in document analysis and data entry.

- Superior visualization: Interactive ownership trees make even multi-layered structures simple to understand.

- Guided workflow: Task lists and task states direct analysts exactly where attention is needed.

- Complete control and flexibility: Analysts can edit, add, import, or override, reject and review data or documents at any point.

- Audit-ready transparency: Every step is documented, meeting BaFin, EBA, and EU AMLD compliance standards.

Who benefits most

UBO Drilldown is designed for KYC/AML analysts, compliance officers, and onboarding specialists across banking, fintech, payments, insurance, and other regulated industries. By removing manual bottlenecks, teams can focus on risk assessment, exception handling, and high-value decision-making instead of repetitive research tasks.

Why choose Sinpex

The Sinpex platform combines AI-powered automation with human oversight to make compliance processes faster, smarter, and more reliable. UBO Drilldown is just one of the many features designed to streamline KYC/KYB due diligence while ensuring full regulatory compliance.

Conclusion

UBO identification no longer needs to be the most frustrating part of corporate onboarding. With Sinpex’s UBO Drilldown, compliance teams gain the speed, accuracy, and transparency they need — without sacrificing control.

Ready to see how Sinpex can help your team identify UBOs faster and more accurately? Get in touch with us today for a personalized demo.

Compliance You

Can Bank on

Get the clarity and confidence you deserve with Sinpex today.